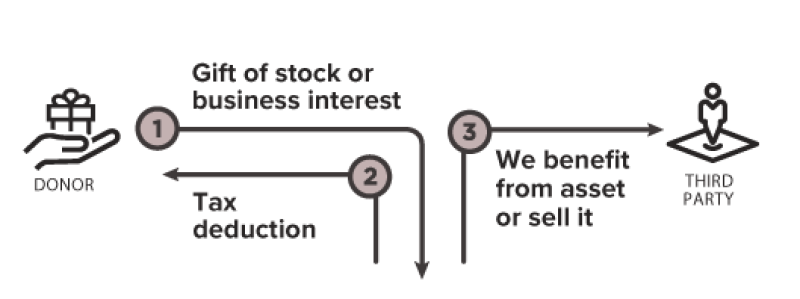

Transfer of Securities

Transferring securities to the Legacy Foundation to benefit the preservation, protection, and enhancement of the Stadium is simple and easy.

Benefits

- You want to deduct the full fair market value of your gift once you have held onto the securities for at least one year.

- You want to avoid paying capital gains tax on the stock donated to the Legacy Foundation.

STEP 1

Initiate the Transfer of Securities

Securities can be gifted to the Rose Bowl Legacy Foundation in two ways: either via electronic transfer (in which your broker transfers shares to our foundation’s broker) or by physically mailing the paper certificates to the Rose Bowl Legacy Foundation. Either method is acceptable, but it is necessary for you to contact your broker to initiate the transfer.

STEP 3

Send the Securities to the Rose Bowl Legacy Foundation

Ask your broker to donate through RBC Wealth Management.

- Account registration name at RBC Wealth Management: Legacy Connections

- RBC Wealth Management’s DTC Number 0235

- Full 8-digit RBC Wealth Management account number: 322-06225

- Tax ID number: 01-0972999 (Legacy Connections)

- Broker’s Name, Company, email, Phone number: Jeffrey Scofield, RBC Wealth Management, Jeffrey.scofield@rbc.com, 626-204-2115